The article proposes accelerating the green transition through a dual approach involving banks and private finance.

Firstly, banks should start redirecting their loans and investments towards more sustainable projects and away from fossil fuel-dependent industries. Funds can be redirected through stricter lending criteria and the introduction of green financial products.

Secondly, it underscores the importance of private finance in filling the funding gap for green projects. The article also highlights the need for private investors to step in and provide the necessary funding, especially for innovative and high-risk green projects that may not typically qualify for traditional bank loans, which can be achieved through green bonds, mutual funds, private equity and venture capital.

Lastly, the article also emphasises the need for government intervention and regulation to ensure that the financial sector is aligned with the goals of the Paris Agreement. For instance, it suggests that governments can provide incentives for green investments and impose penalties for investments in fossil fuels.

The Banking Sector Capitalised on Green Finance in 2023

Global banks continue to capitalise on the momentum of green financing and green bonds, signalling a potential shift away from traditional fossil fuel investments. In 2023, for the second consecutive year, major banks earned more from underwriting bonds and providing loans for environmentally friendly projects than from financing oil, gas, and coal activities. Data compiled by Bloomberg and the banking sector reveals that these financial institutions amassed approximately $3 billion in fees from green initiatives, surpassing the aggregate earnings of less than $2.7 billion from fossil fuel transactions.

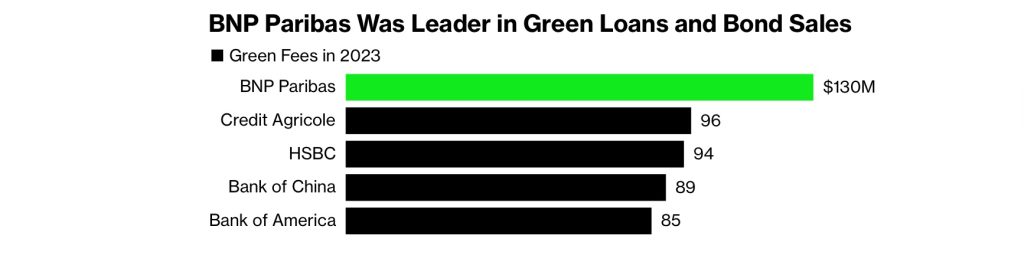

European banks spearheaded this transition, with BNP Paribas SA leading Bloomberg’s green debt league table. BNP, the largest bank in the European Union, raked in nearly $130 million from its green finance endeavours, followed by Credit Agricole AG with $96 million and HSBC Holdings Plc with $94 million.

In contrast, Wall Street dominated fossil finance, with Wells Fargo & Co. and JPMorgan Chase & Co. securing the highest earnings from oil and gas deals. Wells Fargo earned $107 million from arranging bonds and loans for the fossil fuel sector, closely trailed by JPMorgan and Mitsubishi UFJ Financial Group Inc., both with $106 million. MUFG emerged as the leading arranger of global green loans last year. This financial landscape is evolving amidst stricter regulations in Europe, where the European Central Bank and the region’s top banking authority are pushing for an expedited green transition. European lenders now face potential fines and heightened capital requirements if they mishandle climate exposures, prompting many to impose explicit restrictions on fossil finance.

The regulatory outlook remains uncertain and fragmented in the United States, particularly with hurdles presented by Republican states hindering the green transition. Banks perceived as withholding financing from the oil and gas sector face retaliation, with some states threatening to sever ties with Wall Street firms embracing net zero emissions goals.

Despite these shifts, the global finance industry has yet to align with the goals of the Paris climate agreement. According to BloombergNEF analysis, four times as much capital needs to be allocated to green projects as to fossil fuels by 2030 to meet net zero emissions targets. However, at the end of 2022, this ratio stood at just 0.7 to 1, signalling a substantial gap in achieving the necessary transition levels.

Critics argue that global banks must keep pace with the required transition levels, emphasising the urgency to avoid catastrophic climate change. Environmentalists, such as Jason Schwartz from Sunrise Project, a nonprofit focusing on the financial sector’s impact on global warming, stress that banks must accelerate their energy financing transition to meet climate goals.

The past year, declared the hottest on record by the Global Carbon Project, saw a 1.1% increase in carbon dioxide emissions from burning fossil fuels, putting the planet on track to exceed its carbon budget for 1.5°C warming by the decade’s end. Despite the urgency highlighted by these alarming trends, banks extended $583 billion in green bonds and loans in 2023, surpassing the $527 billion allocated to fossil fuel debt. However, the data indicate a slight decline from 2022 figures, with $594 billion directed toward environmental projects compared to $558 billion for oil, gas, and coal.

As major banks publish reports allocating significant sums toward a greener planet, questions arise about the veracity of such claims, given the absence of regulatory guideposts. Stakeholders are now scrutinising these assertions in the context of the broader macroeconomic trends, questioning whether the banking sector’s efforts are proactive in reducing financing for carbon-intensive energy. Given climate change’s global challenges, the pressing need for an accelerated transition in green funding remains evident.

The Private Sectors Role in Green Financing

Private finance, including institutional investors, venture capitalists, and private equity firms, can play a crucial role in accelerating the transition to a green economy. These entities can invest substantial capital into innovative green technologies, renewable energy projects, and other climate-friendly initiatives, which can significantly aid in reducing global carbon emissions.

Institutional investors managing large portfolios, such as pension funds and insurance companies, can allocate a greater proportion of their investments towards green bonds and sustainable equities. Such investments contribute to the global effort to combat climate change and provide reliable returns. As per the MSCI, companies with strong environmental, social, and governance (ESG) profiles have tended to outperform their counterparts in the long run. Consequently, investing in green assets may not just be a moral imperative but a financially prudent decision.

With their high-risk, high-reward investment model, venture capitalists and private equity firms can support early-stage green startups. These startups often need help to secure funding due to the perceived riskiness of their innovative, unproven technologies. However, the success of these ventures could result in game-changing solutions to our climate crisis.

In addition, private finance can promote green transition through impact investing – investments made to generate both a financial return and a measurable environmental impact. This method enables investors to support projects and companies directly, contributing to a sustainable future.

However, for private finance to effectively contribute to the green transition, transparency and standardisation in reporting ESG metrics are crucial. The lack of universally accepted standards for what constitutes a ‘green’ investment can result in ‘greenwashing’, where companies exaggerate or misrepresent their environmental impact. Implementing clear, stringent criteria for green investments will help investors make informed decisions and ensure their capital indeed contributes to environmental sustainability.

Furthermore, governments can catalyse private sector involvement by offering incentives such as tax breaks and subsidies for green investments and implementing policies that make investing in fossil fuel-based industries financially less attractive. The transition to a green economy will require colossal investment; it’s a task too large for public finance to handle alone. Private finance will, therefore, be a necessary partner in this endeavour, potentially offering the scale, innovation, and dynamism needed to achieve our climate goals.

Call to Action

In conclusion, OceanBlocks stands at the precipice of a breakthrough in developing carbon assets that sequester annual carbon effectively. Our strategic focus on mangrove and seaweed plantations spread across diverse geographies represents a tangible commitment to reducing emissions. However, the realisation of this goal relies heavily on securing the right funding partners who share our vision and understand the critical importance of these initiatives. By investing in OceanBlocks, our partners will not only be contributing to a greener future but also investing in the prosperity of communities that are sustained by the natural world. Our collective efforts can create a significant impact that benefits the environment, the people who depend on it, and, ultimately, the health of our planet. With the proper support, OceanBlocks is primed to become an influential player in the global green transition.